AerCap Presentation AerCap Holdings N.V. December 2013

Disclaimer Incl. Forward Looking Statements & Safe Harbor * This presentation may contain certain statements, estimates and forecasts with respect to future performance and events. These statements, estimates and forecasts are intended to be covered by the safe harbor for “forward-looking statements” provided by the US Private Securities Litigation Reform Act of 1995. In some cases, such forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,” “intend,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue” or the negatives thereof or variations thereon or similar terminology. All forward-looking statements included in this presentation are not statements of historical fact but are based on various underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions, and may include projections of future financial performance based on growth strategies and anticipated trends in our businesses. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause actual results, level of activity performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied in any forward-looking statements. As a result, there can be no assurance that any forward-looking statements included in this presentation will prove to be accurate or correct. In light of these risks, uncertainties and assumptions, the future performance or events described in any forward-looking statements in this presentation might not occur. Among the factors that could cause actual results to differ materially from those described in any forward-looking statements are factors relating to the ability to consummate the proposed transaction between AerCap and ILFC; the ability to obtain requisite regulatory, shareholder and other approvals as well as the satisfaction of other conditions to the proposed transaction; the ability of AerCap to successfully integrate ILFC’s operations and employees and realize anticipated synergies and cost savings; the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers and competitors; and changes in general economic, business and political conditions, including changes in the financial markets, as well as those factors described under the headings “Risk Factors” in AerCap’s and ILFC’s respective annual reports on Form 20-F and Form 10-K for the year ended December 31, 2012, as filed with the US Securities and Exchange Commission (the “SEC”). Copies of such annual reports on Form 20-F and Form 10-K are available online at http://www.sec.gov or on request from each company. Except for any obligation to disclose material information under federal securities laws, AerCap and ILFC do not undertake any obligation to, and will not, update any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and AerCap and ILFC do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. The information in this document is confidential and the property of AerCap Holdings N.V. and its subsidiaries and may not be copied or communicated to a third party, or used for any purpose other than that for which it is supplied without the express written consent of AerCap Holdings N.V. and its subsidiaries. No warranty or representation is given concerning such information, which must not be taken as establishing any contractual or other commitment binding upon AerCap Holdings N.V. or any of its subsidiaries or associated companies.

Non-GAAP Information * Discussions during this conference call will include certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles. Reconciliations of those non-U.S. GAAP financial measures to the most directly comparable U.S. GAAP financial measures can be found in the 2012 Annual Report on Form 20-F and Form 10-K and the reports on Form 6-K and 10-Q for AerCap and ILFC, respectively.

Creating the industry leader *

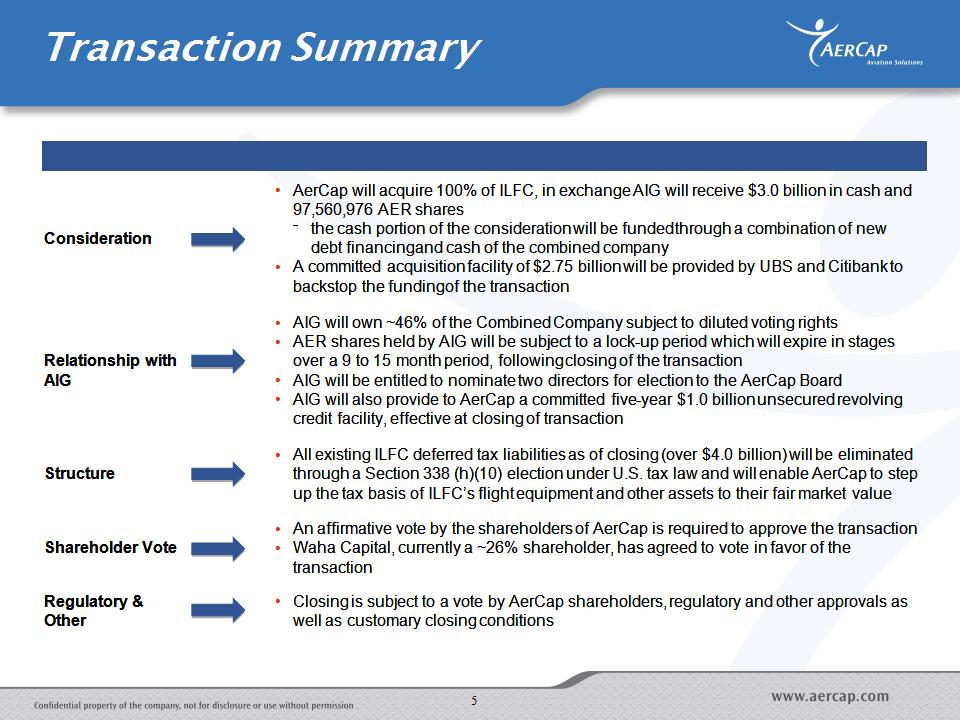

Transaction Summary Consideration AerCap will acquire 100% of ILFC, in exchange AIG will receive $3.0 billion in cash and 97,560,976 AER shares the cash portion of the consideration will be funded through a combination of new debt financing and cash of the combined company A committed acquisition facility of $2.75 billion will be provided by UBS and Citibank to backstop the funding of the transaction Relationship with AIG AIG will own ~46% of the Combined Company subject to diluted voting rights AER shares held by AIG will be subject to a lock-up period which will expire in stages over a 9 to 15 month period, following closing of the transaction AIG will be entitled to nominate two directors for election to the AerCap Board AIG will also provide to AerCap a committed five-year $1.0 billion unsecured revolving credit facility, effective at closing of transaction Structure All existing ILFC deferred tax liabilities as of closing (over $4.0 billion) will be eliminated through a Section 338 (h)(10) election under U.S. tax law and will enable AerCap to step up the tax basis of ILFC’s flight equipment and other assets to their fair market value Shareholder Vote An affirmative vote by the shareholders of AerCap is required to approve the transaction Waha Capital, currently a ~26% shareholder, has agreed to vote in favor of the transaction Regulatory & Other Closing is subject to a vote by AerCap shareholders, regulatory and other approvals as well as customary closing conditions *

Strategic Rationale for ILFC Acquisition AerCap's acquisition of ILFC will create the leading global franchise in the aircraft leasing industry The combination presents a unique strategic opportunity to bring together the outstanding and experienced personnel from both companies, along with a diverse portfolio of modern aircraft and customers, coupled with an attractive order book comprised of state-of-the-art aircraft These combined resources along with a strong liquidity profile provide the opportunity to drive high levels of stable long term profitability and cash flows for the benefit of all our stakeholders The transaction provides immediate value creation for AerCap shareholders with run-rate pro forma earnings per share of $4.00+ Meaningful opportunities exist to better optimize ILFC's fleet, stemming from AerCap's position as one of the most active aircraft portfolio managers in the world, and the ability to utilize AeroTurbine’s capabilities The aircraft leasing business is very scalable and the transaction provides substantial opportunities to produce meaningful cost savings and operating efficiencies Relocation of ILFC's assets is necessary to align the assets with the operating platform of the Combined Company as AerCap already operates in Ireland. The transfer of assets will produce a reduction in the tax expense of the Combined Company based on the Irish tax rate The acquisition will be prudently capitalized with a combination of debt and equity, providing solid support for contracted orders and rapid deleveraging *

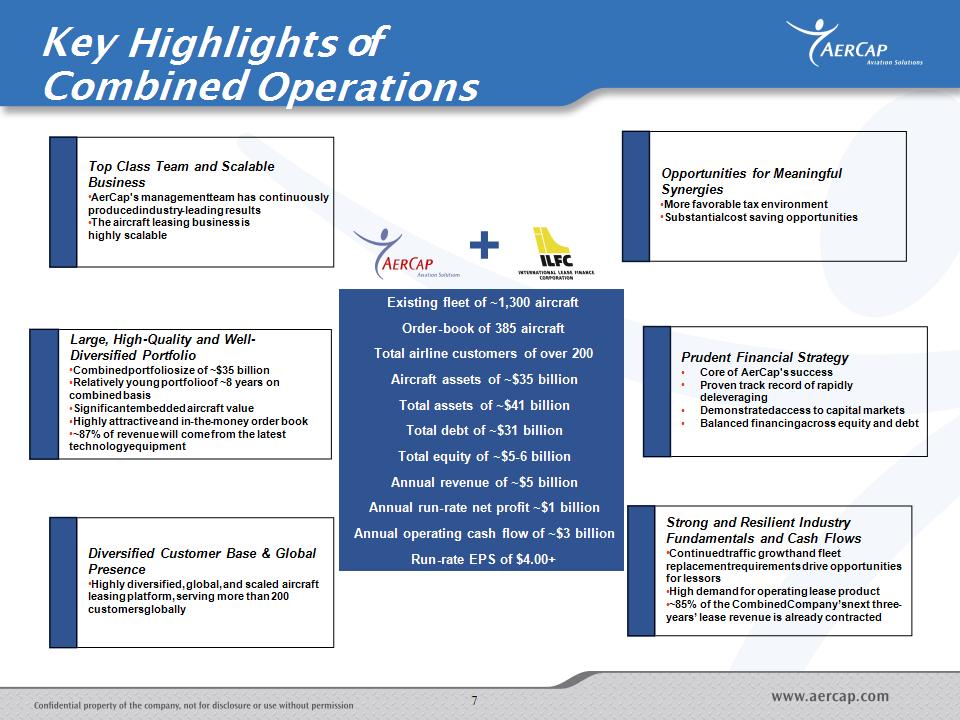

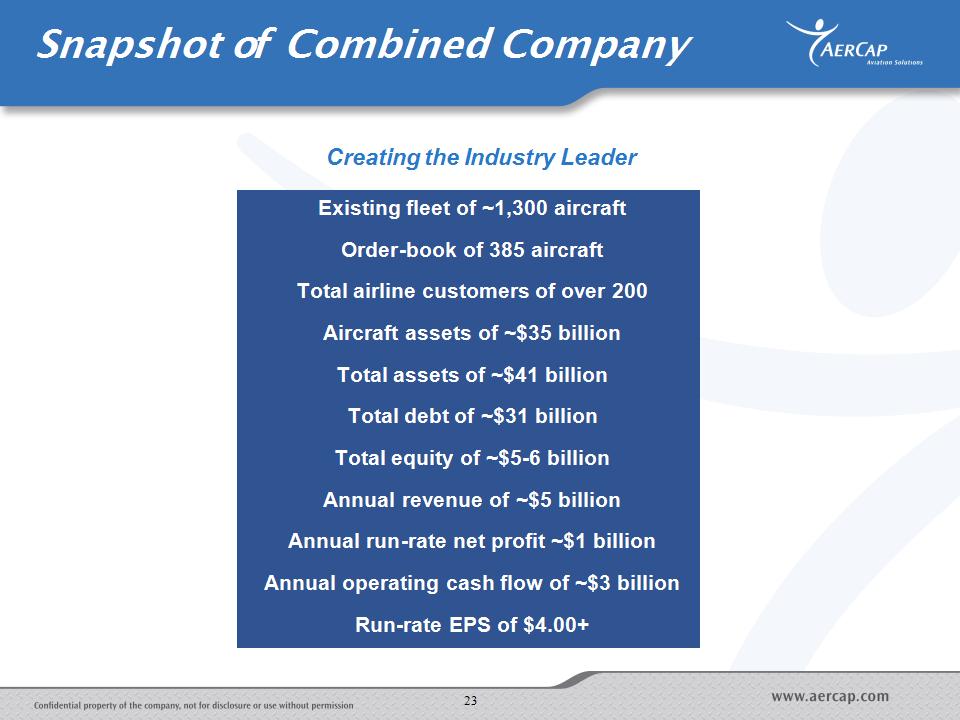

Key Highlights of Combined Operations * Top Class Team and Scalable Business AerCap's management team has continuously produced industry-leading results The aircraft leasing business is highly scalable Prudent Financial Strategy Core of AerCap's success Proven track record of rapidly deleveraging Demonstrated access to capital markets Balanced financing across equity and debt Opportunities for Meaningful Synergies More favorable tax environment Substantial cost saving opportunities Diversified Customer Base & Global Presence Highly diversified, global, and scaled aircraft leasing platform, serving more than 200 customers globally Large, High-Quality and Well-Diversified Portfolio Combined portfolio size of ~$35 billion Relatively young portfolio of ~8 years on combined basis Significant embedded aircraft value Highly attractive and in-the-money order book ~87% of revenue will come from the latest technology equipment Strong and Resilient Industry Fundamentals and Cash Flows Continued traffic growth and fleet replacement requirements drive opportunities for lessors High demand for operating lease product ~85% of the Combined Company’s next three-years’ lease revenue is already contracted Existing fleet of ~1,300 aircraft Order-book of 385 aircraft Total airline customers of over 200 Aircraft assets of ~$35 billion Total assets of ~$41 billion Total debt of ~$31 billion Total equity of ~$5-6 billion Annual revenue of ~$5 billion Annual run-rate net profit ~$1 billion Annual operating cash flow of ~$3 billion Run-rate EPS of $4.00+

AerCap Overview *

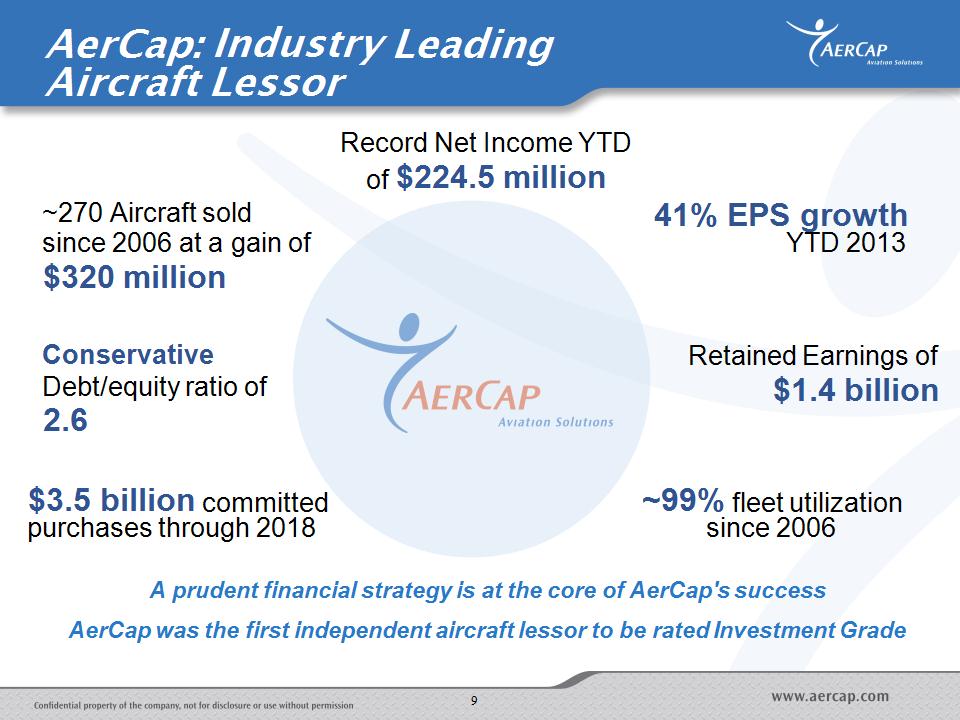

AerCap: Industry Leading Aircraft Lessor * Retained Earnings of $1.4 billion ~99% fleet utilization since 2006 $3.5 billion committed purchases through 2018 Conservative Debt/equity ratio of 2.6 41% EPS growth YTD 2013 ~270 Aircraft sold since 2006 at a gain of $320 million Record Net Income YTD of $224.5 million A prudent financial strategy is at the core of AerCap's success AerCap was the first independent aircraft lessor to be rated Investment Grade

* AerCap’s Business Principles Capital Structure Leasing Strategy Highly diversified customer base Wide geographical coverage Obtain security deposits and maintenance reserves to protect against lessee defaults Proactive risk management Focus on long-term funding to match fund long-term assets Limited financial covenants Flexible repayment profiles Adequate leverage Highly diversified funding sources Hedging Policy Portfolio Management Continually optimize portfolio through aircraft acquisitions and disposals Focus on in-production liquid aircraft types Hedge through a mix of interest rate caps, swaps and fixed-rate loans Provides benefit of decreasing interest rates, while protecting against increasing interest rates AerCap’s operating strategy for the Combined Company will remain focused on the same key principles:

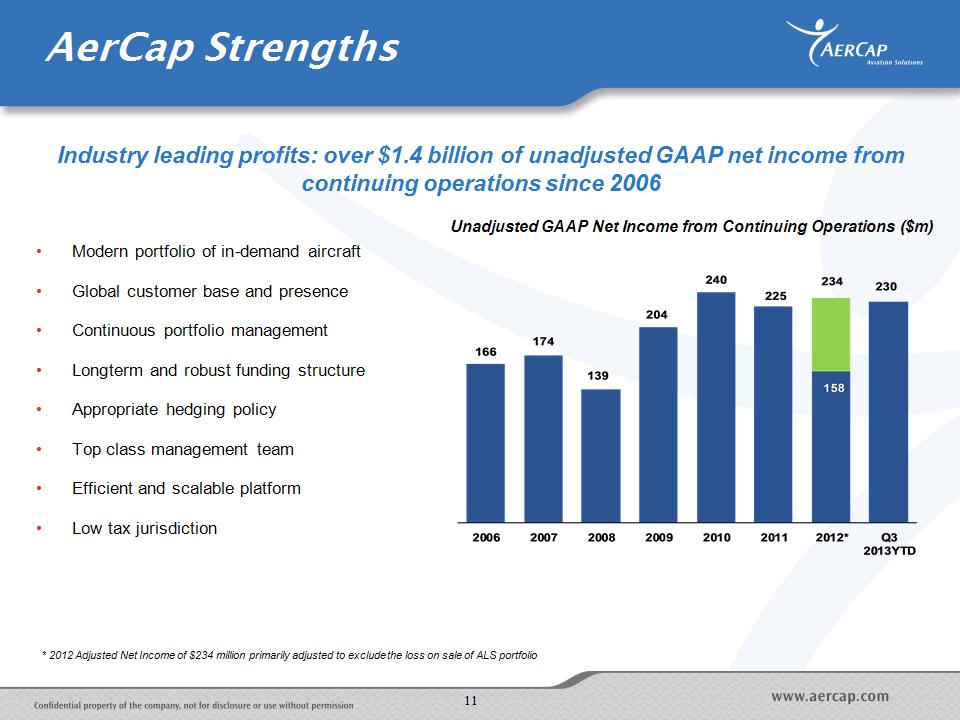

* AerCap Strengths Modern portfolio of in-demand aircraft Global customer base and presence Continuous portfolio management Longterm and robust funding structure Appropriate hedging policy Top class management team Efficient and scalable platform Low tax jurisdiction Unadjusted GAAP Net Income from Continuing Operations ($m) * 2012 Adjusted Net Income of $234 million primarily adjusted to exclude the loss on sale of ALS portfolio Industry leading profits: over $1.4 billion of unadjusted GAAP net income from continuing operations since 2006

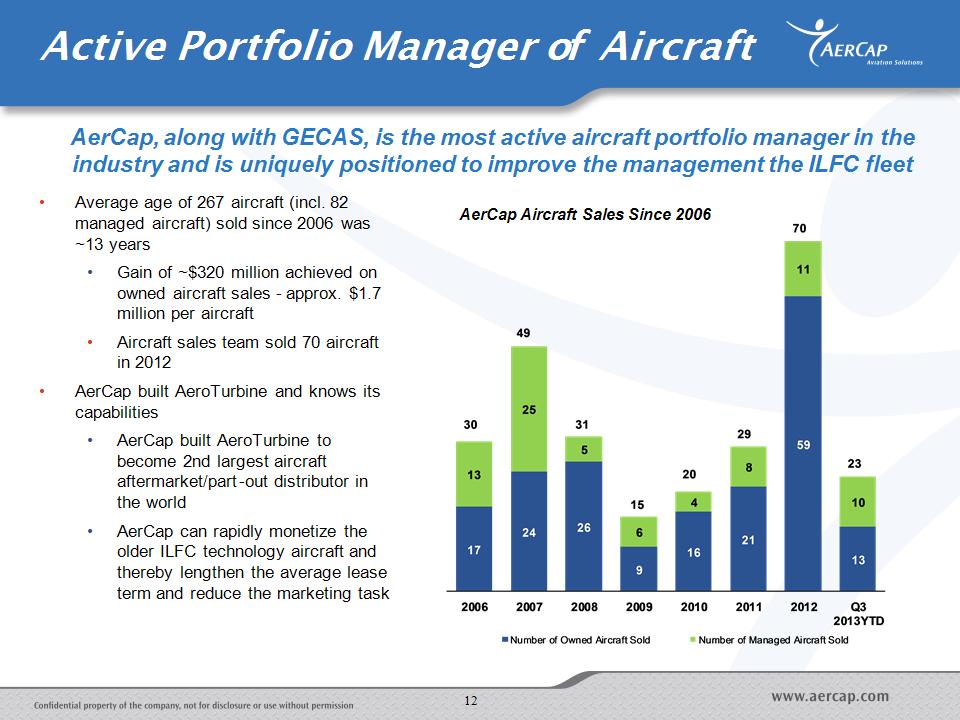

* Active Portfolio Manager of Aircraft AerCap, along with GECAS, is the most active aircraft portfolio manager in the industry and is uniquely positioned to improve the management the ILFC fleet Average age of 267 aircraft (incl. 82 managed aircraft) sold since 2006 was ~13 years Gain of ~$320 million achieved on owned aircraft sales – approx. $1.7 million per aircraft Aircraft sales team sold 70 aircraft in 2012 AerCap built AeroTurbine and knows its capabilities AerCap built AeroTurbine to become 2nd largest aircraft aftermarket/part-out distributor in the world AerCap can rapidly monetize the older ILFC technology aircraft and thereby lengthen the average lease term and reduce the marketing task AerCap Aircraft Sales Since 2006

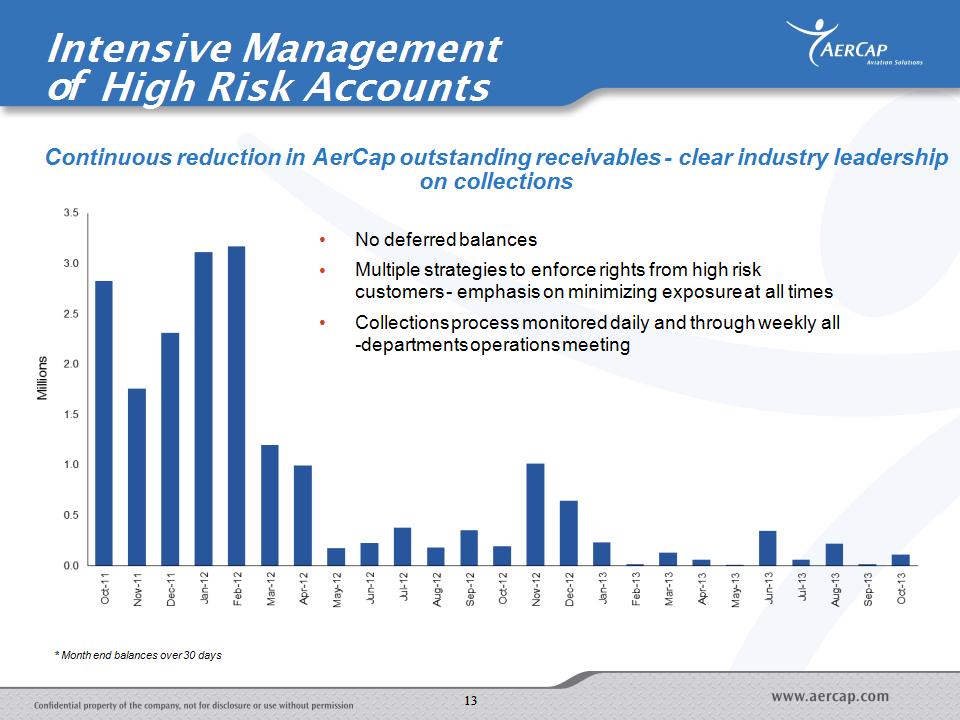

* * Intensive Management of High Risk Accounts * Month end balances over 30 days Continuous reduction in AerCap outstanding receivables – clear industry leadership on collections No deferred balances Multiple strategies to enforce rights from high risk customers – emphasis on minimizing exposure at all times Collections process monitored daily and through weekly all-departments operations meeting

Combined Company *

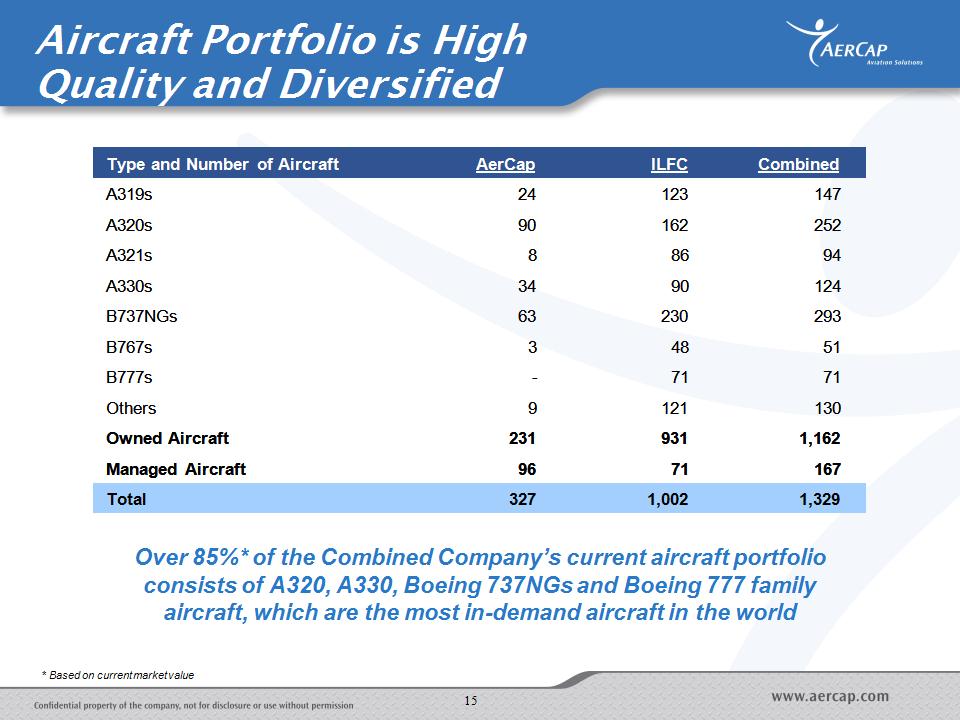

Aircraft Portfolio is High Quality and Diversified * Type and Number of Aircraft AerCap ILFC Combined A319s 24 123 147 A320s 90 162 252 A321s 8 86 94 A330s 34 90 124 B737NGs 63 230 293 B767s 3 48 51 B777s - 71 71 Others 9 121 130 Owned Aircraft 231 931 1,162 Managed Aircraft 96 71 167 Total 327 1,002 1,329 Over 85%* of the Combined Company’s current aircraft portfolio consists of A320, A330, Boeing 737NGs and Boeing 777 family aircraft, which are the most in-demand aircraft in the world * Based on current market value

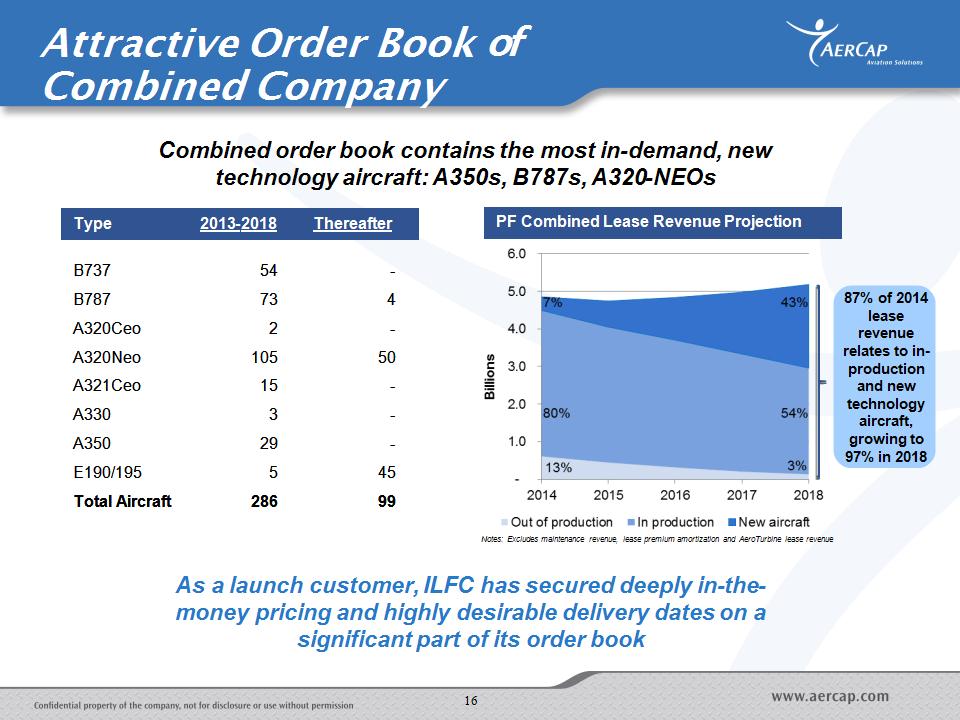

Attractive Order Book of Combined Company * Combined order book contains the most in-demand, new technology aircraft: A350s, B787s, A320-NEOs Type 2013-2018 Thereafter B737 54 - B787 73 4 A320Ceo 2 - A320Neo 105 50 A321Ceo 15 - A330 3 - A350 29 - E190/195 5 45 Total Aircraft 286 99 PF Combined Lease Revenue Projection Notes: Excludes maintenance revenue, lease premium amortization and AeroTurbine lease revenue As a launch customer, ILFC has secured deeply in-the-money pricing and highly desirable delivery dates on a significant part of its order book 87% of 2014 lease revenue relates to in-production and new technology aircraft, growing to 97% in 2018

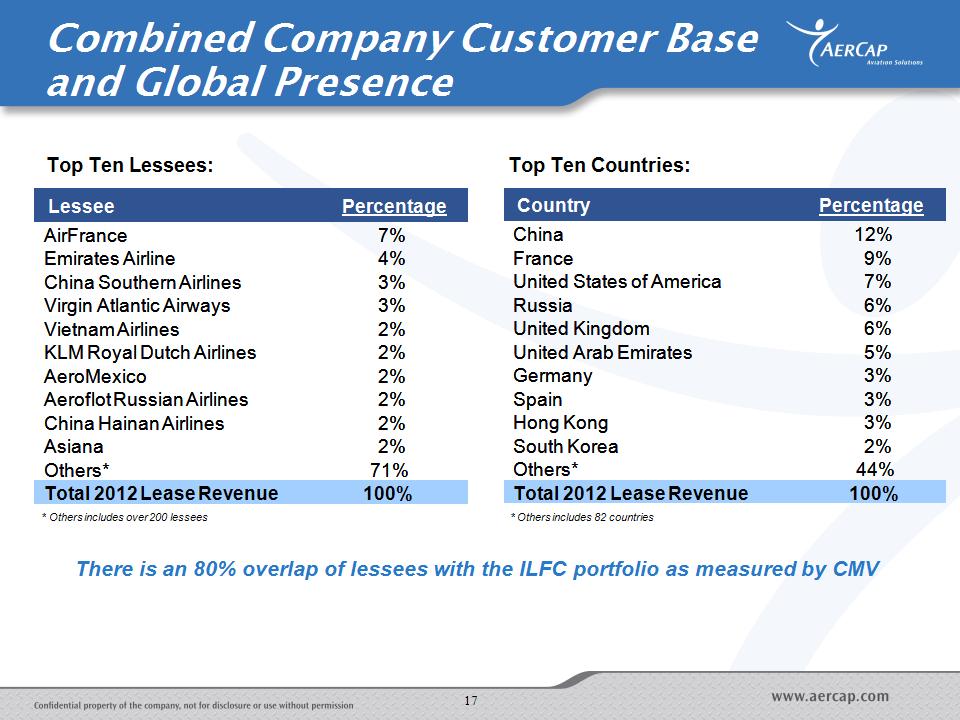

Combined Company Customer Base and Global Presence Top Ten Lessees: Top Ten Countries: * Country Percentage China 12% France 9% United States of America 7% Russia 6% United Kingdom 6% United Arab Emirates 5% Germany 3% Spain 3% Hong Kong 3% South Korea 2% Others* 44% Total 2012 Lease Revenue 100% * Others includes 82 countries Lessee Percentage AirFrance 7% Emirates Airline 4% China Southern Airlines 3% Virgin Atlantic Airways 3% Vietnam Airlines 2% KLM Royal Dutch Airlines 2% AeroMexico 2% Aeroflot Russian Airlines 2% China Hainan Airlines 2% Asiana 2% Others* 71%. Total 2012 Lease Revenue 100% . * Others includes over 200 lessees There is an 80% overlap of lessees with the ILFC portfolio as measured by CMV

Over 200 Airline Customers *

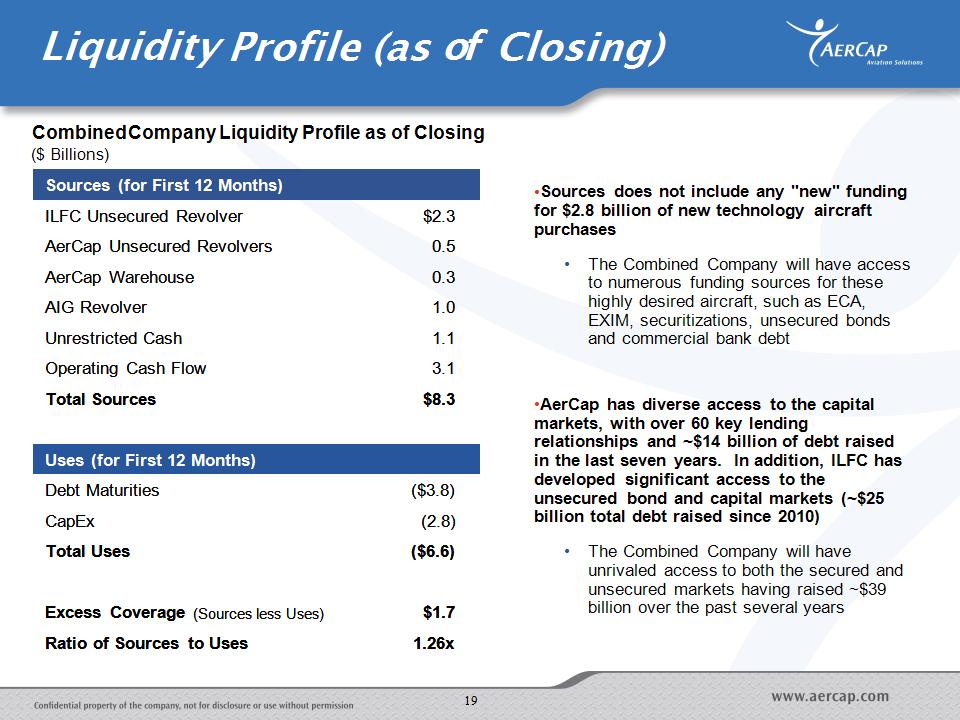

Liquidity Profile (as of Closing) * Sources (for First 12 Months) Sources (for First 12 Months) ILFC Unsecured Revolver $2.3 AerCap Unsecured Revolvers 0.5 AerCap Warehouse 0.3 AIG Revolver 1.0 Unrestricted Cash 1.1 Operating Cash Flow 3.1 Total Sources $8.3 Uses (for First 12 Months) Debt Maturities ($3.8) CapEx (2.8) Total Uses ($6.6) Excess Coverage (Sources less Uses) $1.7 Ratio of Sources to Uses 1.26x Combined Company Liquidity Profile as of Closing ($ Billions) Sources does not include any "new" funding for $2.8 billion of new technology aircraft purchases The Combined Company will have access to numerous funding sources for these highly desired aircraft, such as ECA, EXIM, securitizations, unsecured bonds and commercial bank debt AerCap has diverse access to the capital markets, with over 60 key lending relationships and ~$14 billion of debt raised in the last seven years. In addition, ILFC has developed significant access to the unsecured bond and capital markets (~$25 billion total debt raised since 2010) The Combined Company will have unrivaled access to both the secured and unsecured markets having raised ~$39 billion over the past several years

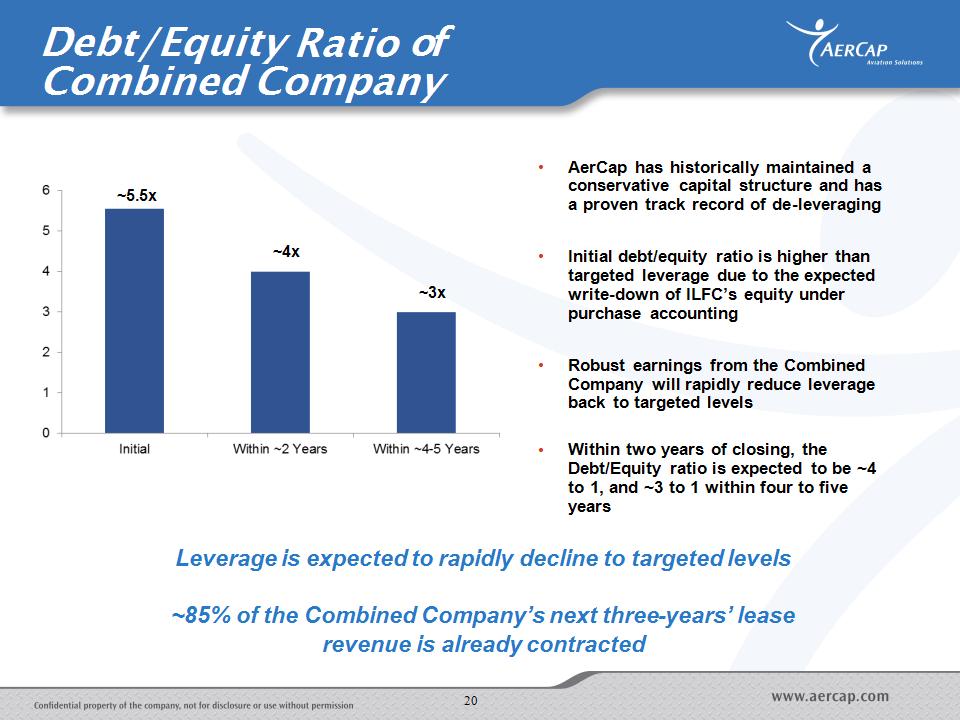

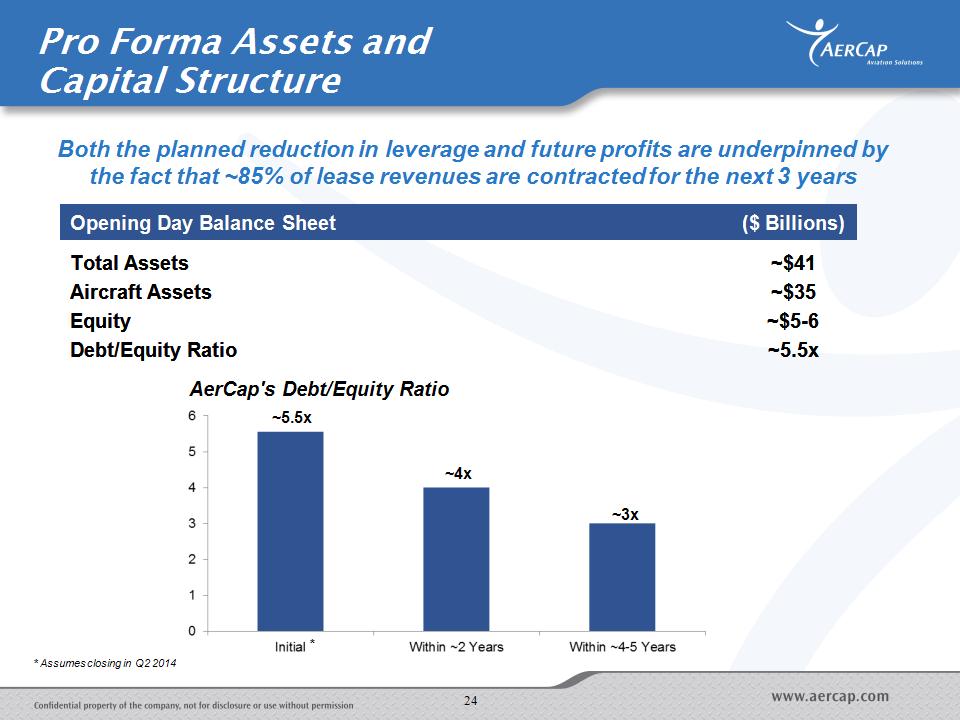

Debt/Equity Ratio of Combined Company * AerCap has historically maintained a conservative capital structure and has a proven track record of de-leveraging Initial debt/equity ratio is higher than targeted leverage due to the expected write-down of ILFC’s equity under purchase accounting Robust earnings from the Combined Company will rapidly reduce leverage back to targeted levels Within two years of closing, the Debt/Equity ratio is expected to be ~4 to 1, and ~3 to 1 within four to five years Leverage is expected to rapidly decline to targeted levels ~85% of the Combined Company’s next three-years’ lease revenue is already contracted ~5.5x ~4x ~3x

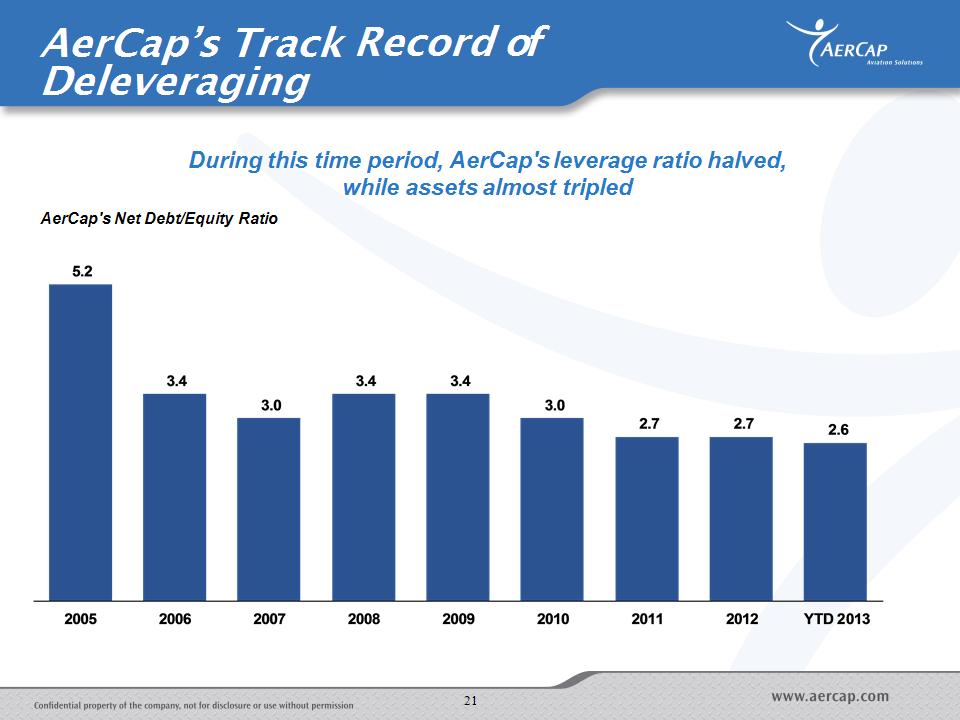

AerCap’s Track Record of Deleveraging * AerCap's Net Debt/Equity Ratio During this time period, AerCap's leverage ratio halved, while assets almost tripled

Pro Forma Financials *

Snapshot of Combined Company * Creating the Industry Leader Existing fleet of ~1,300 aircraft Order-book of 385 aircraft Total airline customers of over 200 Aircraft assets of ~$35 billion Total assets of ~$41 billion Total debt of ~$31 billion Total equity of ~$5-6 billion Annual revenue of ~$5 billion Annual run-rate net profit ~$1 billion Annual operating cash flow of ~$3 billion Run-rate EPS of $4.00+

Opening Day Balance Sheet ($ Billions) Total Assets ~$41 Aircraft Assets ~$35 Equity ~$5-6 Debt/Equity Ratio ~5.5x * Pro Forma Assets and Capital Structure Both the planned reduction in leverage and future profits are underpinned by the fact that ~85% of lease revenues are contracted for the next 3 years ~5.5x ~4x ~3x AerCap's Debt/Equity Ratio * * Assumes closing in Q2 2014

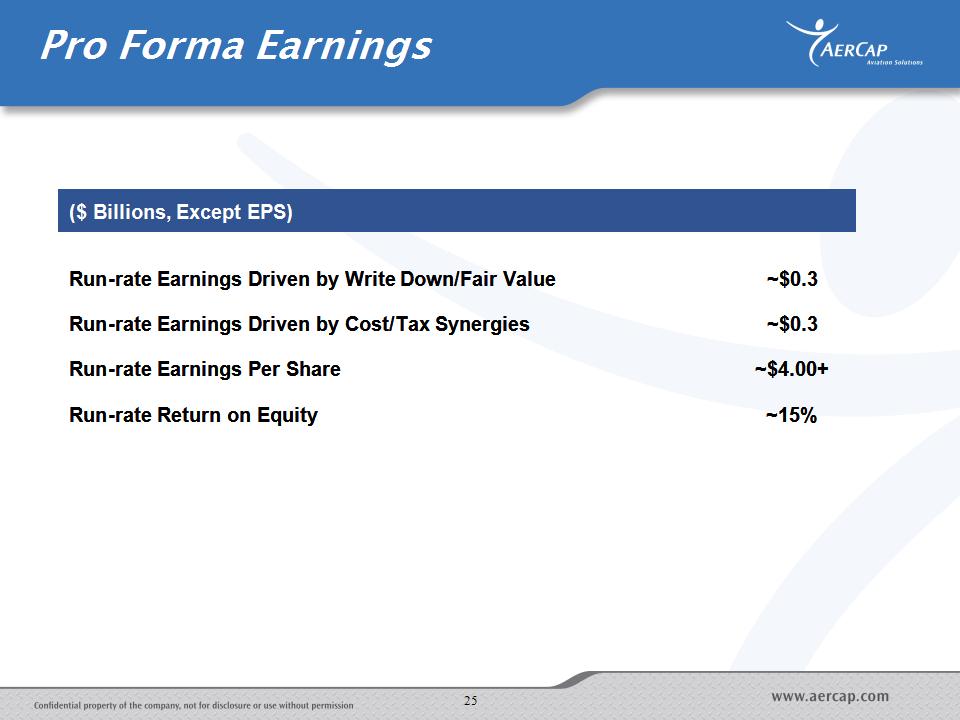

($ Billions, Except EPS) Run-rate Earnings Driven by Write Down/Fair Value ~$0.3 Run-rate Earnings Driven by Cost/Tax Synergies ~$0.3 Run-rate Earnings Per Share ~$4.00+ Run-rate Return on Equity ~15% * Pro Forma Earnings

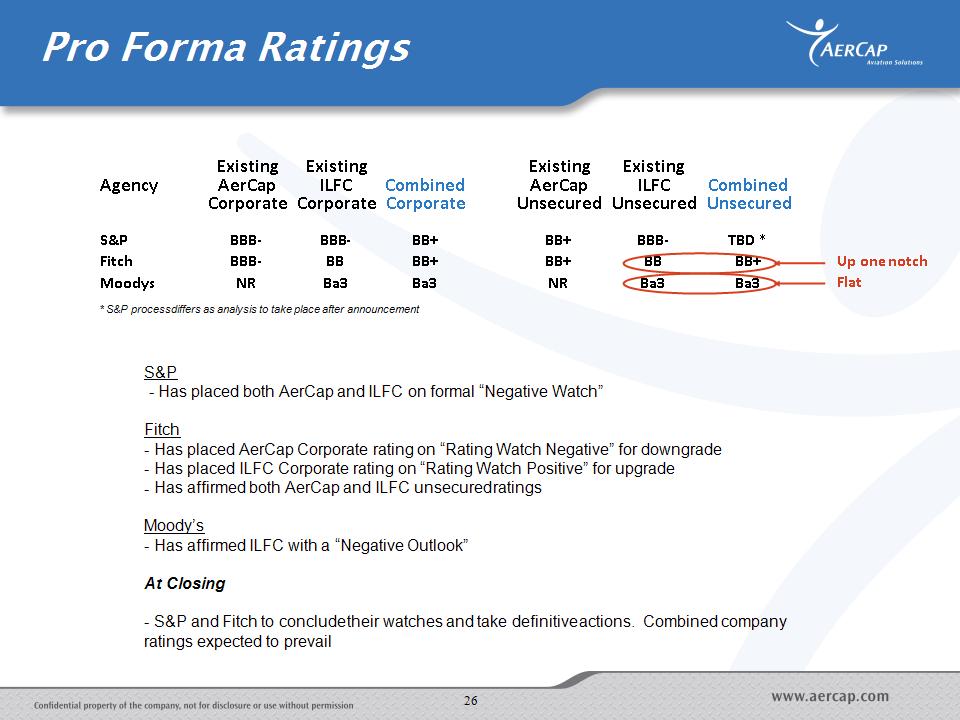

Pro Forma Ratings Existing Existing Existing Existing Agency Agency AerCap ILFC Combined AerCap ILFC Combined Corporate Corporate Corporate Unsecured Unsecured Unsecured S&P BBB- BBB- BB+ BB+ BBB- TBD * Fitch BBB- BB BB+ BB+ BB BB+ Moodys NR Ba3 Ba3 NR Ba3 Ba3 * S&P process differs as analysis to take place after announcement S&P - Has placed both AerCap and ILFC on formal “Negative Watch” Fitch - Has placed AerCap Corporate rating on “Rating Watch Negative” for downgrade - Has placed ILFC Corporate rating on “Rating Watch Positive” for upgrade Has affirmed both AerCap and ILFC unsecured ratings Moody’s - Has affirmed ILFC with a “Negative Outlook” At Closing - S&P and Fitch to conclude their watches and take definitive actions. Combined company ratings expected to prevail * Up one notch Flat

Capital Management We expect the Combined Company to have deep access to all funding markets Combined, AerCap and ILFC have raised over $39 billion of financing in the last several years – many times the expected financing need of the Combined Company over the next few years The Combined Company has very manageable capital expenditures of approximately $3 billion per annum over the next 3 years for deliveries of new aircraft We also expect to sell approximately $1 billion of aircraft per annum, the level of sales AerCap has executed on a stand-alone basis Given the Combined Company's access to the global financing markets and our strong contracted operating cash flow, we view the capital requirements of the Combined Company as very manageable *

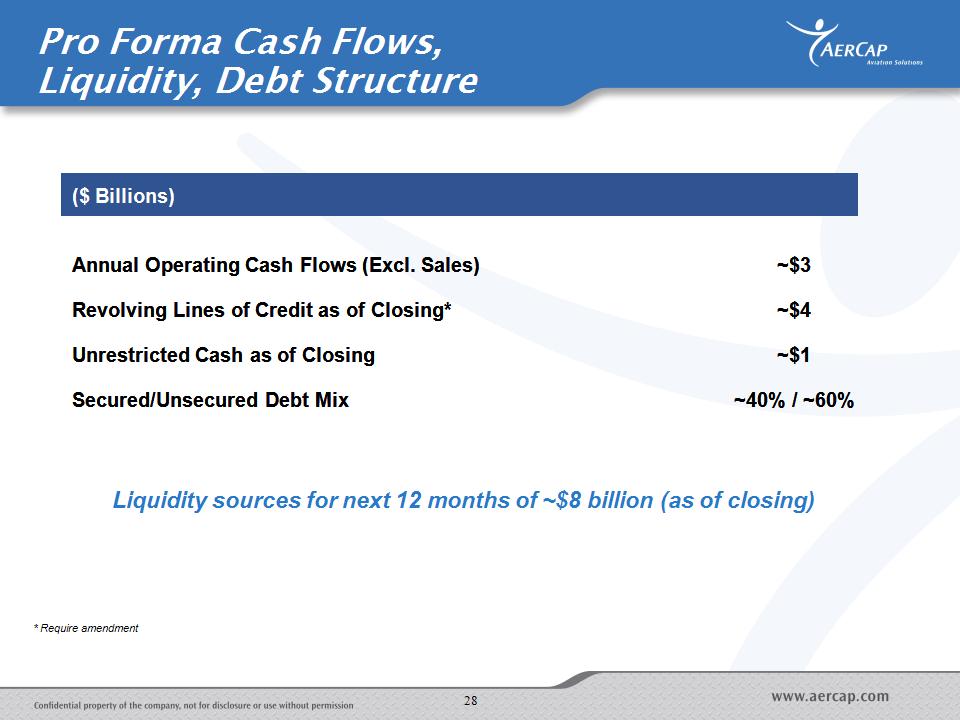

($ Billions) Annual Operating Cash Flows (Excl. Sales) ~$3 Revolving Lines of Credit as of Closing* ~$4 Unrestricted Cash as of Closing ~$1 Secured/Unsecured Debt Mix ~40% / ~60% * Pro Forma Cash Flows, Liquidity, Debt Structure Liquidity sources for next 12 months of ~$8 billion (as of closing) * Require amendment

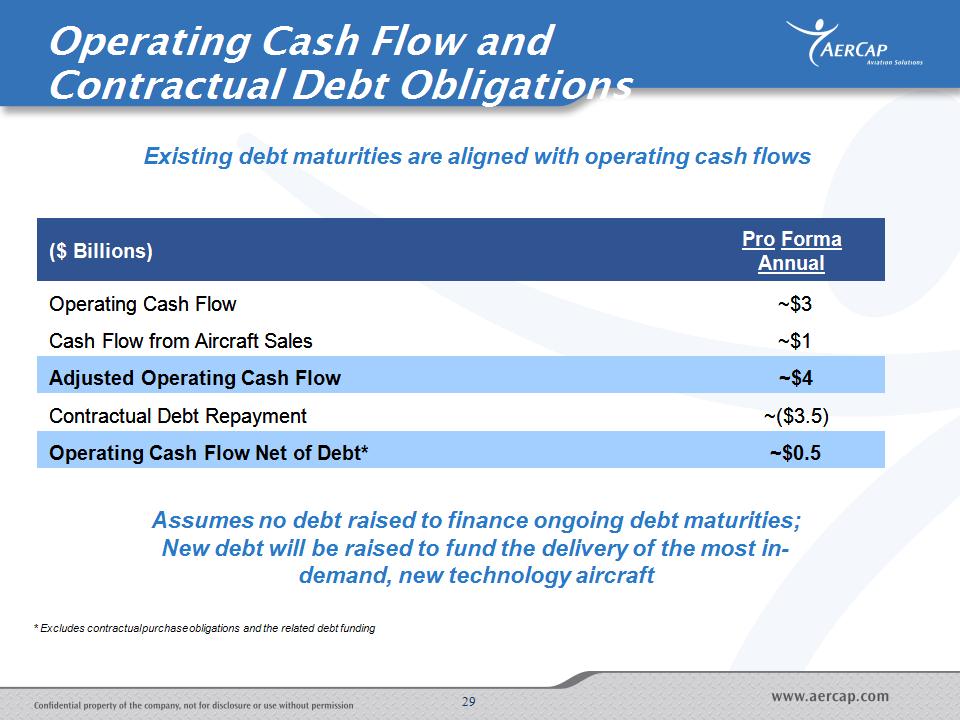

Operating Cash Flow and Contractual Debt Obligations * ($ Billions) Pro Forma Annual Operating Cash Flow ~$3 Cash Flow from Aircraft Sales ~$1 Adjusted Operating Cash Flow ~$4 Contractual Debt Repayment ~($3.5) Operating Cash Flow Net of Debt* ~$0.5 Assumes no debt raised to finance ongoing debt maturities; New debt will be raised to fund the delivery of the most in-demand, new technology aircraft * Excludes contractual purchase obligations and the related debt funding Existing debt maturities are aligned with operating cash flows

Next Steps, Timeline, & Summary *

Integration Priorities * * Transfer of Assets Alignment of Operating Systems Combination of Operating Platforms/Transfer of Personnel Portfolio optimization/aircraft sales Receivables Management

Next Steps and Transaction Timeline * Shareholder Vote Required Approvals Closing AerCap will convene a meeting of its shareholders for the purpose of obtaining the required vote. Expected within 60 days Waha Capital, AerCap’s largest shareholder with a current stake of 26%, has agreed to vote in favor of the transaction The transaction is subject to approval by AerCap shareholders, receipt of necessary regulatory and other approvals, as well as satisfaction of other customary closing conditions The timing of closing date will depend on the items above. Expected in Q2 2014

* Creates the Industry Leader Highly Attractive (in-the-money) Order Book Reduction in Tax Expense from Transfer to Existing AerCap Locations Rapidly Improving Operating Metrics Highly Scalable Platform Provides Operating Efficiencies Best in Class Management Team Industry leading franchise with significant scale, deep and broad market penetration, providing a strong partner for airlines and suppliers globally Enhances short and long term quality of asset base and cash flows Key customer to airframe and engine manufacturers Transfer of assets to existing, established AerCap locations (lower tax jurisdiction) Step-up in U.S. tax basis reduces constraints relating to aircraft sales Prudently financed acquisition Proven history/track record of deleveraging Strong cash flow generation Rapid de-risking of balance sheet Highly scalable business Duplicate back-office activities and similar operating locations allow for efficiencies Highly experienced Proven track record Disciplined and conservative track record of liquidity/liability management Key Strengths

Thank you *