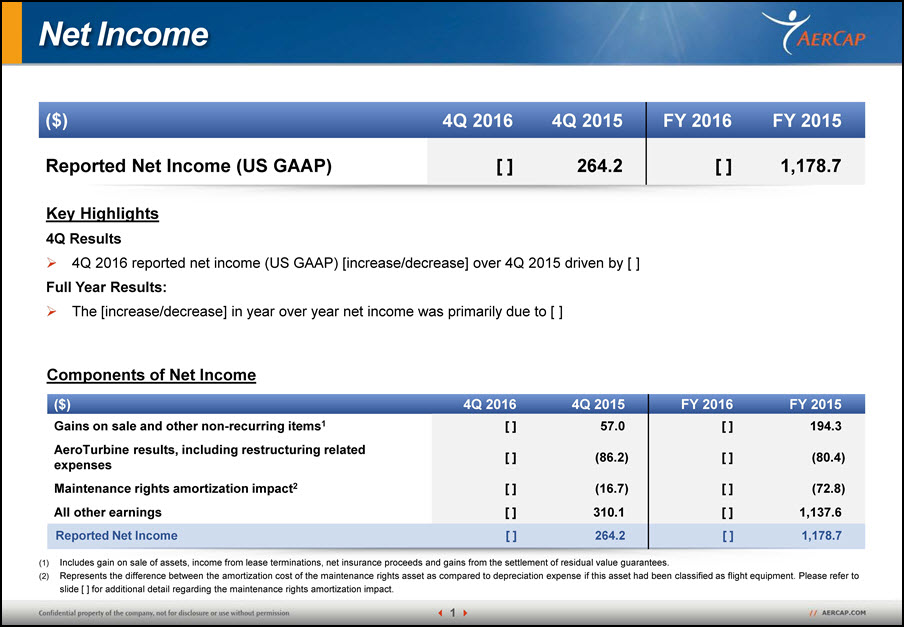

Net Income ($) 4Q 2016 4Q 2015 FY 2016 FY 2015 Reported Net Income (US GAAP) [ ] 264.2 [ ] 1,178.7 Key Highlights4Q Results4Q 2016 reported net income (US GAAP) [increase/decrease] over 4Q 2015 driven by [ ]Full Year Results:The [increase/decrease] in year over year net income was primarily due to [ ] ($) 4Q 2016 4Q 2015 FY 2016 FY 2015 Gains on sale and other non-recurring items1 [ ] 57.0 [ ] 194.3 AeroTurbine results, including restructuring related expenses [ ] (86.2) [ ] (80.4) Maintenance rights amortization impact2 [ ] (16.7) [ ] (72.8) All other earnings [ ] 310.1 [ ] 1,137.6 Reported Net Income [ ] 264.2 [ ] 1,178.7 Components of Net Income Includes gain on sale of assets, income from lease terminations, net insurance proceeds and gains from the settlement of residual value guarantees.Represents the difference between the amortization cost of the maintenance rights asset as compared to depreciation expense if this asset had been classified as flight equipment. Please refer to slide [ ] for additional detail regarding the maintenance rights amortization impact.

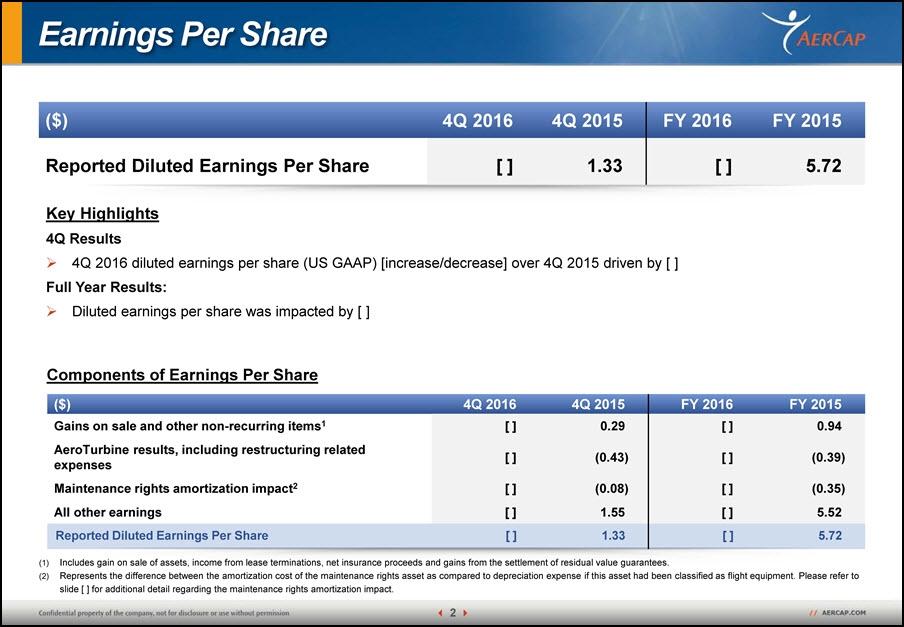

Earnings Per Share ($) 4Q 2016 4Q 2015 FY 2016 FY 2015 Reported Diluted Earnings Per Share [ ] 1.33 [ ] 5.72 Key Highlights4Q Results4Q 2016 diluted earnings per share (US GAAP) [increase/decrease] over 4Q 2015 driven by [ ]Full Year Results:Diluted earnings per share was impacted by [ ] ($) 4Q 2016 4Q 2015 FY 2016 FY 2015 Gains on sale and other non-recurring items1 [ ] 0.29 [ ] 0.94 AeroTurbine results, including restructuring related expenses [ ] (0.43) [ ] (0.39) Maintenance rights amortization impact2 [ ] (0.08) [ ] (0.35) All other earnings [ ] 1.55 [ ] 5.52 Reported Diluted Earnings Per Share [ ] 1.33 [ ] 5.72 Components of Earnings Per Share Includes gain on sale of assets, income from lease terminations, net insurance proceeds and gains from the settlement of residual value guarantees.Represents the difference between the amortization cost of the maintenance rights asset as compared to depreciation expense if this asset had been classified as flight equipment. Please refer to slide [ ] for additional detail regarding the maintenance rights amortization impact.

Appendix

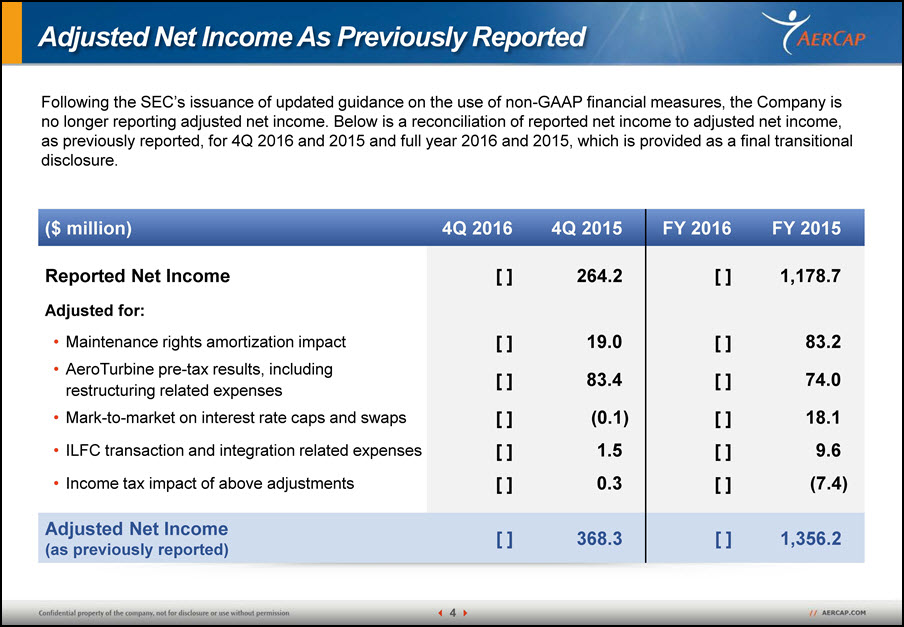

Adjusted Net Income As Previously Reported ($ million) 4Q 2016 4Q 2015 FY 2016 FY 2015 Reported Net Income [ ] 264.2 [ ] 1,178.7 Adjusted for: Maintenance rights amortization impact [ ] 19.0 [ ] 83.2 AeroTurbine pre-tax results, including restructuring related expenses [ ] 83.4 [ ] 74.0 Mark-to-market on interest rate caps and swaps [ ] (0.1) [ ] 18.1 ILFC transaction and integration related expenses [ ] 1.5 [ ] 9.6 Income tax impact of above adjustments [ ] 0.3 [ ] (7.4) Adjusted Net Income (as previously reported) [ ] 368.3 [ ] 1,356.2 Following the SEC’s issuance of updated guidance on the use of non-GAAP financial measures, the Company is no longer reporting adjusted net income. Below is a reconciliation of reported net income to adjusted net income, as previously reported, for 4Q 2016 and 2015 and full year 2016 and 2015, which is provided as a final transitional disclosure.

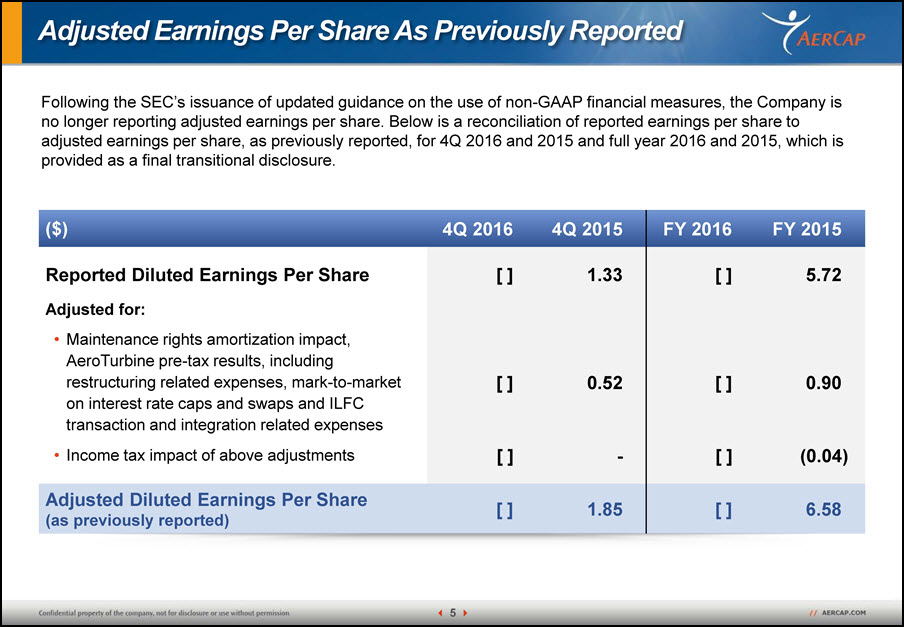

Adjusted Earnings Per Share As Previously Reported ($) 4Q 2016 4Q 2015 FY 2016 FY 2015 Reported Diluted Earnings Per Share [ ] 1.33 [ ] 5.72 Adjusted for: Maintenance rights amortization impact, AeroTurbine pre-tax results, including restructuring related expenses, mark-to-market on interest rate caps and swaps and ILFC transaction and integration related expenses [ ] 0.52 [ ] 0.90 Income tax impact of above adjustments [ ] - [ ] (0.04) Adjusted Diluted Earnings Per Share (as previously reported) [ ] 1.85 [ ] 6.58 Following the SEC’s issuance of updated guidance on the use of non-GAAP financial measures, the Company is no longer reporting adjusted earnings per share. Below is a reconciliation of reported earnings per share to adjusted earnings per share, as previously reported, for 4Q 2016 and 2015 and full year 2016 and 2015, which is provided as a final transitional disclosure.