AerCap Holdings N.V. Reports Record Financial Results

Amsterdam, Netherlands; February 20, 2014 - AerCap Holdings N.V. ("AerCap," "the Company," NYSE: AER)announced that its adjusted net income was $74.9 million for the fourth quarter of 2013, and $299.9 million for the full year 2013. Adjusted earnings per share were $0.66 for the fourth quarter of 2013, an increase of 16% over the fourth quarter of 2012 and adjusted earnings per share for the full year 2013 were $2.64, an increase of 35% over the full year 2012.

Key Highlights

- On December 16, 2013 we entered into a definitive agreement with American International Group, Inc. ("AIG") (NYSE: AIG) ("ILFC Transaction") under which AerCap will acquire 100% of the common stock of International Lease Finance Corporation ("ILFC"), a wholly-owned subsidiary of AIG. The ILFC Transaction is expected to close in the second quarter of 2014, subject to regulatory and other approvals as well as customary closing conditions.

- During 2013 we purchased 38 aircraft with a total value of $1.8 billion and committed future aircraft purchases were $3.5 billion as of December 31, 2013, relating to 44 aircraft. All committed purchases are placed on long term leases with an average term of 11.8 years.

- Trade receivables were $5.2 million as of December 31, 2013, a historical low.

- Our fleet utilization rate was 99.5% for the full year 2013. The average age of the owned fleet as of December 31, 2013 was 5.4 years.

- 197 aircraft transactions were executed during the full year 2013.

- The debt to equity ratio was 2.6 to 1 at December 31, 2013, compared with 2.7 to 1 for the same period in 2012.

Aengus Kelly, CEO of AerCap, commented: "2013 was a milestone year for AerCap on many levels. We entered into the ILFC Transaction which provides a great opportunity for the Company and its shareholders. Further, among other initiatives, we executed a purchase and leaseback with LATAM for 25 widebody aircraft which increases the embedded growth in our portfolio. Finally, we reported exceptional financial results, with adjusted EPS of $2.64 and adjusted net income of $299.9 million, while maintaining a robust liquidity profile. As we look to 2014, AerCap is well positioned to continue delivering these superior financial returns to our shareholders."

Fourth Quarter 2013 Financial Results

- Fourth quarter 2013 reported net income was $65.6 million, compared with $11.2 million for the same period in 2012. Fourth quarter 2013 reported basic earnings per share were $0.58, compared with $0.09 for the same period in 2012.

- Fourth quarter 2013 adjusted net income was $74.9 million, compared with $67.5 million for the same period in 2012. Fourth quarter 2013 adjusted earnings per share were $0.66, compared with $0.57 for the same period in 2012.

- Net interest margin earned on lease assets, or net spread, was $175.7 million in the fourth quarter of 2013 compared with $159.9 million for the same period in 2012. Net interest margin as a percentage of average lease assets was 8.7% for fourth quarter 2013, compared with 8.5% for the same period in 2012.

- Total owned assets were $9.4 billion as of December 31, 2013, an increase of 9% from $8.6 billion as of December 31, 2012. In addition the aircraft in our managed portfolio were valued at $2.4 billiona).

- In the fourth quarter of 2013, we purchased six aircraft and entered into a purchase and leaseback agreement for one additional new Boeing 787-8 aircraft that is still to be delivered.

- During the fourth quarter of 2013 we closed financing transactions totaling $4.1 billion, including $3.8 billion relating to the ILFC Transaction.

(a)a) Includes aircraft under our management and owned by our non-consolidated joint ventures. The aircraft value was based on the average appraised value provided by three external appraisers between February 2013 and September 2013.

Full Year 2013 Financial Results

- Full year 2013 reported net income was $292.4 million, compared with $163.7 million for full year 2012. Full year 2013 reported basic earnings per share was $2.58, compared with $1.24 for full year 2012.

- Full year 2013 adjusted net income was $299.9 million, compared with $258.0 million for full year 2012. Full year 2013 adjusted earnings per share was $2.64, compared with $1.96 for full year 2012.

- Net interest margin earned on lease assets, or net spread, was $663.6 million for the full year 2013 compared with $684.2 million for full year 2012. Net interest margin as a percent to average lease assets was 8.6% for full year 2013 as compared with 8.7% for full year 2012.

Net Income/Earnings Per Share

Set forth below are the details to reconcile reported net income to adjusted net income, including the specific adjustments.

| Three months ended December 31, | Twelve months ended December 31, | |||||

| 2013 | 2012 |

% increase/ (decrease) |

2013 | 2012 | % increase/ (decrease) | |

| (US dollars in millions except share and per share amounts) | ||||||

| Net income | $65.6 | $11.2 | 486% | $292.4 | $163.7 | 79% |

| Adjusted for: mark-to-market of interest rate caps, net of tax | (1.9) | - | NA | (10.2) | 12.5 | NA |

| share-based compensation, net of tax | 2.1 | 1.7 | 24% | 8.1 | 6.3 | 29% |

| non-recurring charges to interest expense from repayment of secured loans | - | - | NA | - | 20.9 | NA |

| net loss on sale of ALS portfolio | - | 54.6 | NA | - | 54.6 | NA |

| transaction expenses | 9.1 | - | NA | 9.6 | - | NA |

| Adjusted net income | $74.9 | $67.5 | 11% | $299.9 | $258.0 | 16% |

| Adjusted earnings per share | $0.66 | $0.57 | 16% | $2.64 | $1.96 | 35% |

Fourth quarter 2013 adjusted net income increased 11% over the same period in 2012 driven primarily by higher lease income during the fourth quarter of 2013.

Fourth quarter 2013 adjusted earnings per share increased 16% over the same period in 2012 driven primarily by the higher income as discussed above as well as the share repurchases completed in 2012.

Revenue and Net Spread

| Three months ended December 31, | Twelve months ended December 31, | |||||

| 2013 | 2012 | % increase/ (decrease) | 2013 | 2012 | % increase/ (decrease) | |

| (US dollars in millions) | ||||||

| Lease revenue: | ||||||

| Basic lease rents | $234.9 | $222.2 | 6% | $901.6 | 931.9 | (3%) |

| Maintenance rents and other receipts | 26.6 | 11.2 | 138% | 74.5 | 65.3 | 14% |

| Lease revenue | 261.5 | 233.4 | 12% | 976.1 | 997.2 | (2%) |

| Net gain (loss) on sale of assets | 9.6 | (47.5) | NA | 41.9 | (46.4) | NA |

| Management fees and interest revenue | 6.5 | 6.0 | 8% | 26.2 | 19.7 | 33% |

| Other revenue | 0.2 | 0.3 | (33%) | 5.9 | 2.0 | 195% |

| Total revenue | $277.8 | $192.2 | 45% | $1,050.1 | $972.5 | 8% |

Basic lease rents were $234.9 million for the fourth quarter of 2013, compared with $222.2 million in the same period in 2012. The increase was driven primarily by new aircraft purchases. Our average lease assets were $8.1 billion, compared with $7.5 billion for the same period in 2012.

Lease revenue for the fourth quarter of 2013 was $261.5 million, compared with $233.4 million for the same period in 2012.

Net gain on sale of assets for the fourth quarter of 2013 was $9.6 million, compared to a loss of $47.5 million for the same period in 2012 which included a $59.9 million pretax loss on sale of the ALS portfolio. Net gain on sale of assets excluding this $59.9 million loss was $12.4 million in the fourth quarter of 2012 and $13.5 million for the full year 2012.

Other revenue for the fourth quarter of 2013 was $0.2 million, largely unchanged from the same period in 2012.

| Three months ended December 31, | Twelve months ended December 31, | |||||

| 2013 | 2012 | % increase/ (decrease) | 2013 | 2012 | % increase/ (decrease) | |

| (US dollars in millions) | ||||||

| Basic lease rents | $234.9 | $222.2 | 6% | $901.6 | $931.9 | (3%) |

| Interest on debt | 57.0 | 62.3 | (9%) | 226.3 | 286.0 | (21%) |

| Adjusted for: mark-to-market of interest rate caps | 2.2 | - | NA | 11.7 | (14.4) | NA |

| non-recurring charges to interest expense from repayment of secured loans | - | - | NA | - | (23.9) | NA |

| Interest on debt excluding the impact of mark-to-market of interest rate caps and non-recurring charges to interest expense from repayment of secured loans | 59.2(a) | 62.3(a) | (5%) | 238.0(a) | 247.7(a) | (4%) |

| Net interest margin, or net spread | $175.7 | $159.9 | 10% | $663.6 | $684.2 | (3%) |

(a) Interest on debt excluding the above non-recurring charges for the three months ended December 31, 2013 and 2012 includes $7.3 million and $6.7 million of amortization of debt issuance costs, respectively. Interest on debt excluding the above non-recurring charges for the twelve months ended December 31, 2013 and 2012 includes $29.6 million and $27.1 million of amortization of debt issuance costs, respectively.

As shown in the table above, interest expense excluding the impact of the mark-to-market of interest rate caps and non-recurring charges was $59.2 million in the fourth quarter of 2013, a 5% decrease compared with the same period in 2012. Net spread was $175.7 million in the fourth quarter of 2013, compared with $159.9 million in the same period in 2012.

Selling, General and Administrative Expenses

| Three months ended December 31, | Twelve months ended December 31, | |||||

| 2013 | 2012 |

% increase/ (decrease) |

2013 | 2012 |

% increase/ (decrease) |

|

| (US dollars in millions) | ||||||

| Mark-to-market of foreign currency hedges, foreign currency balances and other derivatives |

- | $0.1 | NA | $0.1 | $(2.9) | NA |

| Share-based compensation expenses | 2.4 | 1.9 | 26% | 9.3 | 7.5 | 24% |

| Other selling, general and administrative expenses | 19.5 | 21.1 | (8%) | 79.7 | 78.8 | 1% |

| Total selling, general and administrative expenses | $21.9 | $23.1 | (5%) | $89.1 | $83.4 | 7% |

Effective Tax Rate

AerCap's blended effective tax rate during the full year of 2013 was 8.4%. The blended effective tax rate in 2012 was 5.2%. The blended effective tax rate in any year is impacted by the source and amount of earnings among AerCap's different tax jurisdictions. The 2012 tax rate was reduced by the loss from the ALS transaction and non-recurring charges from repayment of certain secured loans.

Financial Position

| December 31, 2013 | December 31, 2012 |

% increase/ (decrease) over December 31, 2012 |

|

| (US dollars in millions except d/e ratio) | |||

| Total cash (incl. restricted) | $563.4 | $800.2 | (30%) |

| Flight equipment held for operating leases, net | 8,085.9 | 7,261.9 | 11% |

| Total assets | 9,446.2 | 8,633.0 | 9% |

| Debt | 6,236.9 | 5,803.5 | 7% |

| Total liabilities | 7,017.0 | 6,510.1 | 8% |

| Total equity | 2,429.2 | 2,122.9 | 14% |

| Debt/equity ratio | 2.6 | 2.7 | (4%) |

As of December 31, 2013, AerCap's portfolio consisted of 378 aircraft that were owned, on order, under contract, managed or owned by AerDragon, a non-consolidated joint venture. The average age of the owned fleet as of December 31, 2013 was 5.4 years and the average remaining contracted lease term was 6.6 years.

Notes Regarding Financial Information Presented In This Press Release

The financial information presented in this press release is not audited.

The following is a definition of non-GAAP measures used in this press release and a reconciliation of such measure to the most closely related GAAP measure:

Adjusted net income and adjusted earnings per share. These measures are determined by adding non-cash charges related to the mark-to-market losses on our interest rate caps and share based compensation during the applicable period, net of related tax benefits, to GAAP net income. The average number of shares is based on a daily average.

In addition, adjusted net income excludes the following non-recurring charges:

- Fourth quarter 2013 adjusted net income of $74.9 million excludes transaction expenses relating to the ILFC transaction, incurred to date, of $9.1 million, net of tax.

- Fourth quarter 2012 adjusted net income of $67.5 million excludes the loss on sale of the ALS portfolio of $54.6 million, net of tax.

- Twelve months ended December 31, 2013 adjusted net income of $299.9 million excludes transaction expenses relating to the ILFC transaction, incurred to date, of $9.6 million, net of tax.

- Twelve months ended December 31, 2012 adjusted net income of $258.0 million excludes the non-recurring charges to interest expense from the early repayment of secured loans of $20.9 million, net of tax and the loss on sale of the ALS portfolio of $54.6 million, net of tax.

In addition to GAAP net income and earnings per share, we believe these measures may provide investors with supplemental information regarding our operational performance and may further assist investors in their understanding of our operational performance in relation to past and future reporting periods. We use interest rate caps to allow us to benefit from decreasing interest rates and protect against the negative impact of rising interest rates on our floating rate debt. Management determines the appropriate level of caps in any period with reference to the mix of floating and fixed cash flows from our lease, debt and other contracts. We do not apply hedge accounting to our interest rate caps. As a result, we recognize the change in fair value of the interest rate caps in our income statement during each period.

The following is a reconciliation of adjusted net income to net income for the three and twelve month periods ended December 31, 2013 and 2012:

| Three months ended December 31, | Twelve months ended December 31, | ||||||

| 2013 | 2012 |

% increase/ (decrease) |

2013 | 2012 |

% increase/ (decrease) |

||

| (US dollars in millions) | |||||||

| Net income | $65.6 | $11.2 | 486% | $292.4 | $ | $163.7 | 79% |

| Adjusted for: mark-to-market of interest rate caps, net of tax | (1.9) | - | NA | (10.2) | 12.5 | NA | |

| share-based compensation, net of tax | 2.1 | 1.7 | 24% | 8.1 | 6.3 | 29% | |

| Net income excluding the impact of mark-to-market of interest rate caps and share-based compensation | 65.8 | 12.9 | 410% | 290.3 | 182.5 | 59% | |

| non-recurring charges to interest expense from repayment of secured loans | - | - | NA | - | 20.9 | NA | |

| net loss on sale of ALS portfolio | - | 54.6 | NA | - | 54.6 | NA | |

| transaction expenses | 9.1 | - | NA | 9.6 | - | NA | |

| Adjusted net income | $74.9 | $67.5 | 11% | $299.9 | $258.0 | 16% | |

Net interest margin, or net spread (refer to second table under Revenue and Net Spread section of this press release). This measure is the difference between basic lease rents and interest expense excluding the impact from the mark-to-market of interest rate caps. We believe this measure may further assist investors in their understanding of the changes and trends related to the earnings of our leasing activities. This measure reflects the impact from changes in the number of aircraft leased, lease rates, utilization rates, as well as the impact from changes in the amount of debt and interest rates.

Conference Call

In connection with the earnings release, management will host an earnings conference call today, Thursday, February 20, 2014, at 9:00 am Eastern Time / 3:00 pm Central European Time. The call can be accessed live by dialling (U.S./Canada) +1-646-254-3367 or (International) +31-20-716-8295 and referencing code 7171079 at least 5 minutes before start time, or by visiting AerCap's website at http://www.aercap.com under "Investor Relations".

In addition, an Investor & Analyst Meeting will be hosted by AerCap's management today, Thursday, February 20, 2014, at 11:30 am Eastern Time at The New York Palace Hotel (Holmes room), 455 Madison Avenue, New York. Doors will open at 11:00 am.

A webcast replay of the earnings conference call will be archived in the "Investor Relations" section of the Company's website for one year.

To participate in either event, please register by emailing: aercap@instinctif.com

For further information, contact Peter Wortel: +31-20-655-9658 (pwortel@aercap.com) or Mark Walter and Jenny Payne (Instinctif Partners): +44-20-7457-2020 (aercap@instinctif.com).

About AerCap Holdings N.V.

AerCap is one of the world's leading aircraft leasing companies and has one of the youngest fleets in the industry. AerCap is a New York Stock Exchange-listed company (AER) and has its headquarters in the Netherlands with offices in Ireland, the United States, China, Singapore and the United Arab Emirates.

Forward Looking Statements

This press release contains certain statements, estimates and forecasts with respect to future performance and events. These statements, estimates and forecasts are "forward-looking statements". In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as "may," "might," "should," "expect," "plan," "intend," "estimate," "anticipate," "believe," "predict," "potential" or "continue" or the negatives thereof or variations thereon or similar terminology. All statements other than statements of historical fact included in this press release are forward-looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied in the forward-looking statements. As a result, there can be no assurance that the forward-looking statements included in this press release will prove to be accurate or correct. In light of these risks, uncertainties and assumptions, the future performance or events described in the forward-looking statements in this press release might not occur. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. We do not undertake any obligation to, and will not, update any forward-looking statements, whether as a result of new information, future events or otherwise.

For more information regarding AerCap and to be added to our email distribution list, please visit http://www.aercap.com.

Financial Statements Follow

AerCap Holdings N.V.

Unaudited Consolidated Balance Sheets

(In thousands of U.S. Dollars)

| December 31, 2013 | December 31, 2012 | |

| Assets | ||

| Cash and cash equivalents | $295,514 | $520,401 |

| Restricted cash | 267,847 | 279,843 |

| Trade receivables | 5,203 | 6,636 |

| Flight equipment held for operating leases, net | 8,085,947 | 7,261,899 |

| Net investment in direct finance leases | 31,995 | 21,350 |

| Notes receivables | 75,788 | 78,163 |

| Prepayments on flight equipment | 223,815 | 53,594 |

| Investments | 112,380 | 93,862 |

| Intangibles | 9,354 | 18,100 |

| Derivative assets | 32,673 | 9,993 |

| Deferred income taxes | 121,663 | 131,296 |

| Other assets | 184,022 | 157,851 |

| Total Assets | $9,446,201 | $8,632,988 |

| Liabilities and Equity | ||

| Accounts payable | $829 | $740 |

| Accrued expenses and other liabilities | 103,522 | 91,951 |

| Accrued maintenance liability | 466,293 | 421,830 |

| Lessee deposit liability | 92,660 | 86,268 |

| Debt (*) | 6,236,892 | 5,803,499 |

| Deferred revenue | 47,698 | 39,547 |

| Derivative liabilities | 7,233 | 14,677 |

| Deferred income taxes | 61,842 | 51,570 |

| Total liabilities | 7,016,969 | 6,510,082 |

| Ordinary share capital €0.01 par value (250,000,000 ordinary shares authorized, 113,783,799 ordinary shares issued and outstanding at December 31, 2013 and 113,363,535 ordinary shares issued and outstanding at December 31, 2012. | 1,199 | 1,193 |

| Additional paid-in capital | 934,024 | 927,617 |

| Accumulated other comprehensive loss. | (9,890) | (14,401) |

| Accumulated retained earnings | 1,500,039 | 1,207,629 |

| Total AerCap Holdings N.V. shareholders' equity | 2,425,372 | 2,122,038 |

| Non-controlling interest | 3,860 | 868 |

| Total Equity | 2,429,232 | 2,122,906 |

| Total Liabilities and Equity | $9,446,201 | $8,632,988 |

| * Includes subordinated debt received from our joint venture partners, the amount of which was $64.3 million as of December 31, 2013. | ||

| Supplemental information | December 31, 2013 | December 31, 2012 |

| Debt/equity ratio. | 2.6 | 2.7 |

| Debt/equity ratio (adjusted for subordinated debt) | 2.5 | 2.6 |

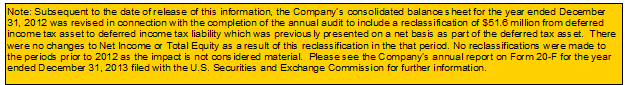

Certain reclassifications have been made to the prior year Unaudited Consolidated Balance Sheet to reflect the current year presentation.

AerCap Holdings N.V.

Unaudited Consolidated Income Statements

(In thousands of U.S. Dollars, except share and per share data)

| Three months ended December 31, | Twelve months ended December 31, | |||

| 2013 | 2012 | 2013 | 2012 | |

| Revenues | ||||

| Lease revenue | $261,533 | $233,396 | $976,147 | $997,147 |

| Net gain (loss) on sale of assets | 9,633 | (47,456) | 41,873 | (46,421) |

| Management fee revenue | 5,087 | 4,915 | 20,651 | 17,311 |

| Interest revenue | 1,364 | 1,120 | 5,525 | 2,471 |

| Other revenue | 217 | 248 | 5,870 | 2,012 |

| Total Revenues | 277,834 | 192,223 | 1,050,066 | 972,520 |

| Expenses | ||||

| Depreciation | 88,731 | 81,868 | 337,730 | 357,347 |

| Asset impairment | 14,301 | 5,226 | 26,155 | 12,625 |

| Interest on debt | 56,987 | 62,301 | 226,329 | 286,019 |

| Operating lease-in costs | - | 1,625 | 550 | 6,119 |

| Leasing expenses | 17,698 | 12,465 | 48,473 | 72,122 |

| Transaction expenses | 10,447 | - | 10,959 | - |

| Selling, general and administrative expenses | 21,930 | 23,079 | 89,079 | 83,409 |

| Total Expenses | 210,094 | 186,564 | 739,275 | 817,641 |

| Income from continuing operations before income taxes and income of investments accounted for under the equity method | 67,740 | 5,659 | 310,791 | 154,879 |

| Provision for income taxes | (5,367) | 162 | (26,026) | (8,067) |

| Net income of investments accounted for under the equity method | 3,487 | 3,261 | 10,637 | 11,630 |

| Net income | 65,860 | 9,082 | 295,402 | 158,442 |

| Net (income) loss attributable to non-controlling interest | (237) | 2,071 | (2,992) | 5,213 |

| Net income attributable to AerCap Holdings N.V. | $65,623 | 11,153 | 292,410 | 163,655 |

| Total basic earnings per share | $0.58 | $0.09 | $2.58 | $1.24 |

| Total diluted earnings per share | $0.57 | $0.09 | $2.54 | $1.24 |

| Weighted average shares outstanding - basic | 113,580,722 | 119,152,475 | 113,463,813 | 131,492,057 |

| Weighted average shares outstanding - diluted | 115,335,886 | 120,226,583 | 115,002,458 | 132,497,913 |

AerCap Holdings N.V.

Unaudited Consolidated Statements of Cash Flows

(In thousands of U.S. Dollars)

|

Three months ended December 31, |

Twelve months ended December 31, |

|||

| 2013 | 2012 | 2013 | 2012 | |

| Net income | $65,860 | $9,082 | $295,402 | $158,442 |

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||

| Depreciation | 88,731 | 81,868 | 337,730 | 357,347 |

| Asset impairment | 14,301 | 5,226 | 26,155 | 12,625 |

| Amortization of debt issuance costs and debt discount | 3,163 | 2,155 | 11,824 | 32,327 |

| Amortization of intangibles | 2,212 | 2,850 | 8,746 | 11,577 |

| Net gain on sale of assets | (9,633) | 47,456 | (41,873) | 46,421 |

| Mark-to-market of non-hedged derivatives | (2,205) | (402) | (11,805) | 2,059 |

| Deferred taxes | 5,341 | (230) | 21,186 | 7,695 |

| Share-based compensation | 2,378 | 1,917 | 9,292 | 7,127 |

| Changes in assets and liabilities: | ||||

| Trade receivables and notes receivable, net | 2,969 | 1,411 | 2,854 | 912 |

| Inventories | - | 430 | - | 7,877 |

| Other assets and derivative assets | (12,207) | 552 | (30,551) | (2,732) |

| Other liabilities | 11,903 | (23,255) | 18,019 | (13,710) |

| Deferred revenue | 1,689 | (1,470) | 8,151 | (2,215) |

| Net cash provided by operating activities | 174,502 | 127,590 | 655,130 | 625,752 |

| Purchase of flight equipment | (232,265) | (360,426) | (1,782,839) | (1,038,657) |

| Proceeds from sale/disposal of assets | 87,163 | 452,957 | 664,415 | 781,278 |

| Prepayments on flight equipment | (57,047) | (6,193) | (213,320) | (36,124) |

| Capital contributions and repayments | - | - | (13,180) | - |

| Movement in restricted cash | 7,397 | 8,493 | 11,996 | (64,491) |

| Net cash (used in) provided by investing activities | (194,752) | 94,831 | (1,332,928) | (357,994) |

| Issuance of debt | 500,138 | 365,255 | 2,299,706 | 1,297,087 |

| Repayment of debt | (491,803) | (278,529) | (1,853,576) | (1,176,508) |

| Debt issuance costs paid | (23,030) | (14,720) | (45,213) | (43,177) |

| Repurchase of shares | - | (102,678) | - | (320,093) |

| Maintenance payments received | 25,748 | 28,196 | 100,708 | 132,046 |

| Maintenance payments returned | (11,201) | (12,976) | (56,909) | (49,728) |

| Security deposits received | 1,784 | 10,591 | 23,364 | 25,624 |

| Security deposits returned | (3,975) | (6,915) | (15,032) | (21,855) |

| Net cash provided by (used in) financing activities | (2,339) | (11,776) | 453,048 | (156,604) |

| Net (decrease) increase in cash and cash equivalents | (22,589) | 210,645 | (224,750) | 111,154 |

| Effect of exchange rate changes | 5 | 102 | (137) | (1,834) |

| Cash and cash equivalents at beginning of period | 318,098 | 309,654 | 520,401 | 411,081 |

| Cash and cash equivalents at end of period | $295,514 | $520,401 | $295,514 | $520,401 |

Certain reclassifications have been made to the prior year Unaudited Consolidated Statement of Cash Flows to reflect the current year presentation.

Released February 20, 2014